If you’ve ever had to deal with insurance, you know how confusing it can be. From deductibles to co-pays and policy limits, there are so many terms and concepts to understand. In this article, we’ll break down some of the most common insurance terms and help you make sense of them.

Deductibles, Co-Pay, and Out of Pocket Maximums

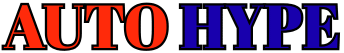

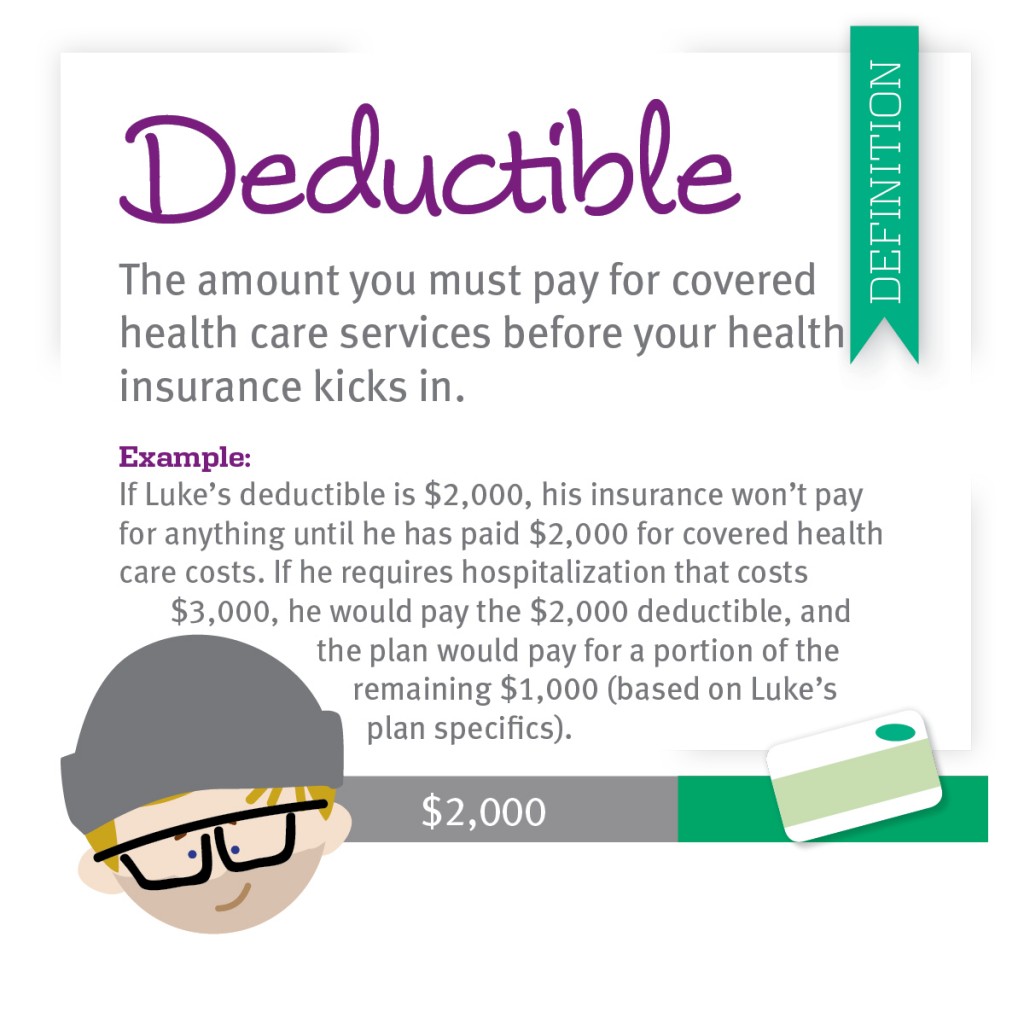

One of the first things you’ll encounter when dealing with insurance is the deductible. This is the amount of money you’ll have to pay out of pocket before your insurance kicks in. For example, if you have a $1,000 deductible and you need to make a claim for $2,000, you’ll have to pay the first $1,000 yourself.

In addition to the deductible, you may also have a co-pay. This is a fixed amount that you’ll have to pay for certain services, such as doctor visits or prescription medications. For example, your insurance plan may require you to pay a $20 co-pay for every doctor visit.

Once you’ve paid your deductible and any applicable co-pays, you may still have to pay out of pocket for certain expenses. This is where the out of pocket maximum comes into play. The out of pocket maximum is the maximum amount of money you’ll have to pay for covered services in a given year. Once you reach this limit, your insurance will cover 100% of the costs.

What Are Insurance Premiums?

Insurance premiums are the regular payments you make to keep your insurance policy active. These payments are typically made monthly, quarterly, or annually, depending on your insurance provider. The amount of your premium will depend on various factors, including your age, location, and the level of coverage you choose.

Understanding Policy Limits

Policy limits refer to the maximum amount of coverage your insurance policy provides. For example, if you have a policy with a $100,000 limit for medical expenses, your insurance will cover up to $100,000 for eligible medical costs. It’s important to be aware of your policy limits and ensure they align with your needs and potential risks.

Insurance can be complicated, but understanding these basic terms can help you navigate the world of insurance with more confidence. Remember to always read your policy carefully and ask your insurance provider any questions you may have. By being informed, you can make better decisions and ensure you have the coverage you need.

source: www.auto-owners.com

The trick to get the right what is insurance deductible is to identify the kind of style right you wanted. We have just what you need here.

source: www.internationalinsurance.com

The trick to find the ideal what is insurance deductible is to spot the kind of idea ideal you wanted. We have what you need here.

source: blog.cdphp.com

The schemes to find the ideal what is insurance deductible is to recognize the kind of need right you wanted. We have exactly what you require here.

We hope these advice help you feel more resourceful and more informed. Our what is insurance deductible articles are a great way to see what {alternative|selection|choice are available and to find out what is trending at the moment. Thank you for reading our article, also check out our other news below!