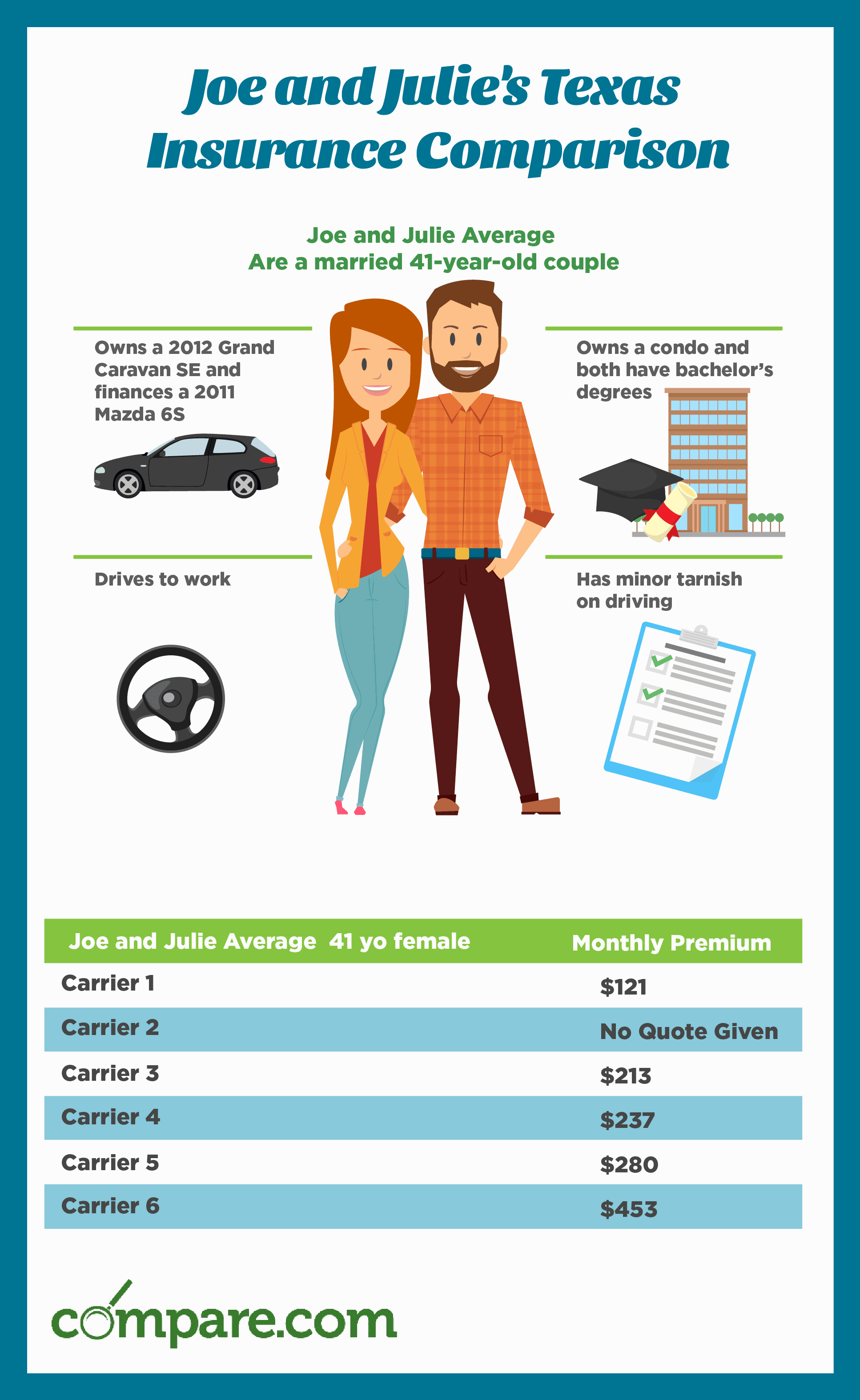

When it comes to car insurance, everyone wants to find the best deal possible. Whether you’re a new driver or just looking to switch providers, comparing different insurance policies is essential. In this article, we’ll explore the world of cheap car insurance and provide you with some helpful tips on how to save money while still getting the coverage you need.

Understanding the Importance of Cheap Car Insurance

Car insurance is a necessary expense for every driver. It provides financial protection in case of accidents, theft, or damage to your vehicle. However, finding affordable car insurance can be a daunting task. That’s where cheap car insurance comparisons come into the picture.

The Benefits of Cheap Car Insurance Comparisons

By comparing different insurance policies, you can find cheaper options that still offer the coverage you need. Cheap car insurance comparisons allow you to assess various features, such as liability or comprehensive coverage, and choose what suits your needs best. These comparisons give you peace of mind, knowing that you’re not overpaying for your insurance.

When comparing car insurance policies, it’s crucial to consider factors like deductibles, coverage limits, and premium rates. Be sure to read the fine print and understand the terms and conditions of each policy before making your decision.

How to Save on Car Insurance

Now that you understand the importance of cheap car insurance, let’s explore some ways you can save money on your coverage:

1. Bundle Your Policies: Many insurance providers offer discounts if you bundle your car insurance with other policies, such as home or life insurance.

2. Increase Your Deductible: Opting for a higher deductible can lower your premium rates, but be sure you can afford to pay the deductible if you need to make a claim.

3. Maintain a Good Driving Record: Safe driving habits and a clean driving record can lead to lower insurance rates and discounts.

4. Install Safety Features: Adding features like anti-theft devices or a dashcam can reduce the risk of theft or accidents, potentially decreasing your insurance premiums.

5. Shop Around: Don’t settle for the first insurance quote you receive. Take the time to compare prices and coverage options from different providers.

By following these tips, you can find a cheap car insurance policy that fits your budget without compromising on coverage.

In conclusion, finding affordable car insurance is possible when you take advantage of cheap car insurance comparisons. By comparing different policies and considering various factors, you can save money while still getting the coverage you need. Remember to shop around and explore different options before making your decision. With proper research and consideration, you can drive with confidence knowing that you’re adequately protected without breaking the bank.

source: www.compare.com

The schemes behind finding the right cheap car insurance comparisons is to recognize the kind of idea right you needed. We have exactly what you are looking for here.

source: www.pinterest.com

The trick to find the right cheap car insurance comparisons is to identify the kind of idea ideal you wanted. We have what you require here.

source: www.pinterest.com

The schemes to find the right cheap car insurance comparisons is to spot the kind of style ideal you wanted. We have what you need here.

We hope these article help you feel more confident and knowledgeable. Our cheap car insurance comparisons galleries are a perfect way to get what {alternative|selection|chinformations are available and to understand what is trending right now. Thank you for reading, also please read our other news below!