Car insurance is an essential aspect of owning a vehicle, providing us with financial protection in the unfortunate event of an accident or damage. It is crucial to have the right coverage to ensure that we are adequately protected. In this article, we will explore the different types of car insurance coverage and why liability is one of the most basic yet important forms.

The Importance of Car Insurance

Car insurance offers a sense of security and peace of mind for car owners. It provides financial protection against various risks, such as accidents, theft, vandalism, and natural disasters. Additionally, it can cover medical expenses for injuries sustained in an accident, legal costs, and property damage.

Understanding Liability Insurance

Liability insurance is one of the most basic types of auto insurance coverage. It is required in most states and covers the cost of damages caused to another party in an accident where you are at fault. This type of coverage ensures that the injured party’s medical bills, property damage, and other related expenses are taken care of.

Liability insurance typically includes two components: bodily injury liability and property damage liability.

Bodily Injury Liability

Bodily injury liability coverage pays for medical expenses, lost wages, and other costs associated with injuries sustained by the other party in an accident you caused. It helps protect you from potentially crippling financial burdens resulting from a lawsuit or hefty medical bills.

Property Damage Liability

Property damage liability coverage, on the other hand, covers the repair or replacement costs of the other party’s property that was damaged in an accident you caused. This can include their vehicle, fence, or any other property affected by the accident.

When selecting your liability insurance coverage limits, it is essential to consider factors such as the value of your assets, potential medical expenses, and local regulations. It is recommended to consult with an insurance agent to determine the appropriate coverage for your specific needs.

Conclusion

Having car insurance is not only a legal requirement in most states, but it also provides us with financial protection and peace of mind. Liability insurance, one of the most basic forms of coverage, ensures that the damages caused to another party in an accident are taken care of. Understanding the different components of liability insurance, including bodily injury and property damage liability, can help us make informed decisions when selecting our coverage limits.

Remember, car insurance is essential for safeguarding your financial well-being in the event of an accident. Be sure to explore different insurance options, compare quotes, and consult with professionals to find the best coverage that suits your needs.

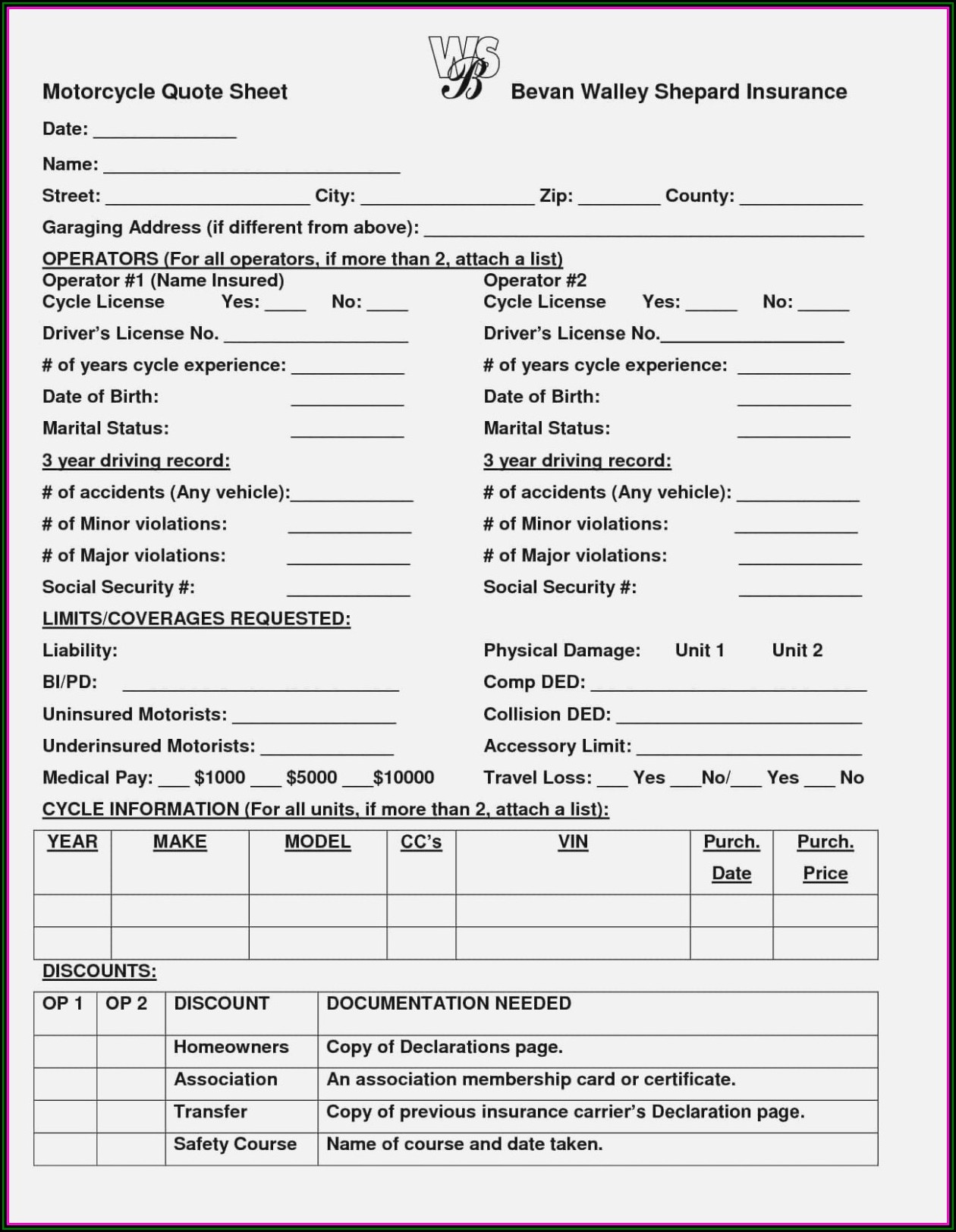

source: www.pinterest.jp

The trick behind finding the perfect personal auto insurance quote is to spot the kind of idea right you wanted. We have just what you require here.

source: www.contrapositionmagazine.com

The schemes to find the perfect personal auto insurance quote is to recognize the kind of need ideal you wanted. We have exactly what you are looking for here.

source: www.pinterest.com

The schemes to get the right personal auto insurance quote is to spot the kind of style right you wanted. We have exactly what you need here.

Hopefully these advice help you feel more resourceful and more informed. Our personal auto insurance quote galleries are a perfect way to get what {alternative|selection|choice are available and to find out what is trending at the moment. Thank you very much for visiting us, also check out our other articles below!